Paul Das: “Digital marketing has become more strategic”

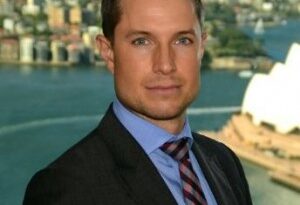

Paul Das, CEO and Founder of ProFundCom has established himself as a crucial partner to fund managers globally. Ahead of a ProFundCom webinar on secret analytical skills for fund marketing teams on 29th July, Hedge Funds Club’s Stefan Nilsson checks in with Paul to find out about the evolution of digital fund marketing and what fund management companies need to know to succeed. Since 2005, ProFundCom’s digital marketing platform serves hedge funds as well as asset managers, wealth managers and private equity managers.

Is the strategic importance of digital marketing becoming more accepted by fund managers now?

Marketing, let alone digital marketing, has been seen as the poor relation of the asset-raising process. Fund managers want to see a return on their marketing investment on factsheet production, website content and CRMs, whilst marketing teams want to demonstrate the impact they are having in the asset-raising process. Digital marketing fits right into that as the analytics provide the sales teams with leads and the marketing team with what themes are working and what themes are not. So, via the backdoor, digital marketing has become more strategic than before.

When it comes to digital marketing for asset managers, do firms nowadays need to employ data scientists and digital marketing experts, or is it more a case of providing the marketers with the right tools?

Data science is not well understood. But one key aspect of data science is that it needs lots and lots of data points that asset management and hedge funds do not produce from their marketing. We know as we have a number of top 100 hedge funds by AUM as clients. The key is to provide a platform that provides summary and detailed information for sales and marketing to raise AUM. That is the key objective for any digital marketing team in fund marketing.

Many marketers seem to be collecting a lot of data. But are they actually making proper use of the data they collect when it comes to doing effective fund marketing? What are the biggest data mistakes that you see in the fund industry?

The biggest mistake is that they spend so much time and money collecting the data they fail to actually do any marketing. What compounds the problem is when they are collecting data for the sake of collecting data with no measurable business outcomes in mind – that is called the dashboard. A picture that seems to tell you a lot, without telling you anything.

How reliable and useful are analytics in today’s digital marketing world? There seem to be new obstacles popping up frequently that marketers need to navigate around.

Elon Musk found out the secret of paid ads – bots and fake accounts. We have developed technology that relies on AI and machine learning to filter our false and anonymous traffic and only report on identifiable and verified data.

Do you see any issues with some firms getting lost in all the data and analytics and forgetting that they have a story to tell in order to achieve their capital-raising goals?

It all about strategic narrative. Most firms are still struggling with that let alone getting caught up in marketing analytics. Without a strategic narrative and a story to tell that feeds into content, the analytics generated serve no real purpose.

Is your upcoming webinar useful for both fund marketers and CEOs, CIOs, CFOs and COOs that may need to better understand how marketing works?

It will help the C-suite and fund marketers to focus on marketing and aligning that with sales and leave the heavy lifting to platforms specifically built for that.

More information on the 29th July webinar on digital fund marketing can be found here!