Scott Treloar: “There is a better way”

In the second part of his interview with the Hedge Funds Club’s Stefan Nilsson, Noviscient’s founder Scott Treloar talks about the obstacles to change in the asset management industry and the evolution of a digital operating model. “We are like a bento box that delivers an entire meal”, says Scott as the discussion continues.

Scott is the founder of Noviscient in Singapore. He has lectured on portfolio risk management at Henley Business School and previously served as Chief Risk Officer at Vulpes Investment Management. He co-founded the hedge fund Novalis Capital and his career has also included stints at Deutsche Bank, Committed Capital and Macquarie Bank.

What are the obstacles to change in order to create a better asset management industry?

Any business can be decomposed into three activities: a) doing things, b) making decisions, and c) abiding by the rules. The asset management industry operating model is physical, rather than digital, and does all three of these activities poorly. Its processes for creating and distributing products are manual, expensive and slow. Decision-making is ad hoc, often lacks access to relevant data and embeds biases. Compliance with the relevant rules and regulations is expensive and poor as it relies on people somehow translating large swathes of regulations to their day-to-day activities. These inefficiencies, embedded in the physical operating model of the industry, necessitate high fees to allow the incumbent firms to continue to exist. In simple terms, asset managers focus on growing assets under management (AUM) to generate management fees to fund their inefficient operations. This is not what clients need. This operating model is not aligned with client interests and is, in fact, transferring wealth from them. There is a better way. We can build a digital asset manager that eliminates costs, improves decisions and enables a better operating model that focuses on creating wealth for its clients.

What are the benefits of this new way of operating?

Here at Noviscient, we are pushing towards a better future for the asset management industry. We were born digital which means our platform, data and processes all operate in the cloud. Our digital operating model gives us tremendous advantages. By removing manual processes, we are progressively pushing our variable costs towards zero, which aligns us with investors by focusing on performance rather than management fees. We are implementing a sequential decision-making framework to help identify, and then implement, optimal decision policies allowing us to offer customised solutions to investors. Having mapped our processes, we can link them directly to the full set of rules and regulations to offer affirmative and continuous compliance. In short, we are reimagining an investment management industry that puts its clients first. By moving our processes, decision-making and compliance from the human to the machine domain, we move from a slow, expensive and imperfect business model to one that is faster, more efficient and safer. It allows us to offer investors performance and customisation within an aligned and safe operating framework.

How are you progressing?

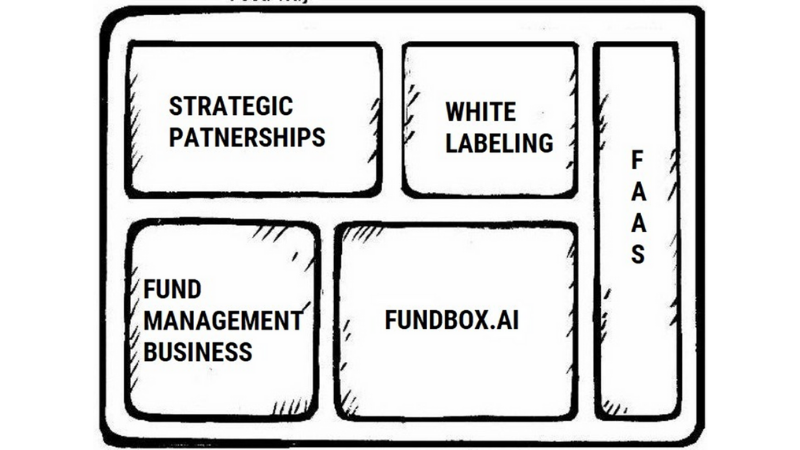

A digital operating model opens up many opportunities. So, rather than thinking of Noviscient as a single dish, we are more like a bento box that delivers an entire meal.

We are operating a pure alpha fund solution with zero management fees. And we plan to create dynamic alpha plus beta solutions that can be easily customised to different investor requirements that may change over time. Our FundBox.ai business is getting good traction. We partner with prospective fund managers anywhere in the world to set up and operate new fund vehicles at a fraction of the cost of doing it themselves. As an example, we are currently working on the set up of a $200m Woman Fund that consists entirely of women-led portfolio managers. We will also shortly be launching our “factsheet as a service” to provide a low-cost, flexible factsheet offering to help asset management with this very painful process. So, if you are an investor or a fund manager or anyone interested in working with us to bring asset management into the 21st century, please get in touch.

Read the first part of the interview here.