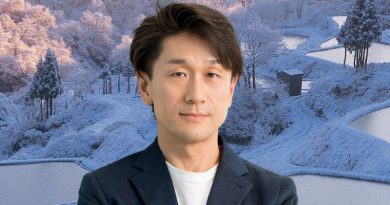

Portal Digital Fund’s Mark Witten: “Psychology is everything”

As cryptocurrencies and other digital assets are becoming mainstream, more and more digital asset funds are starting to pop up. The Hedge Funds Club’s Stefan Nilsson talks with Mark Witten in Australia, the CIO of the Portal Digital Fund, a fund of digital hedge funds that is housed on the First Degree Global Asset Management’s fund platform.

Mark Witten started his career at RMB Asset Management in 2000 before joining Goldman Sachs Asset Management in London. Later he moved to South Africa and worked at Peregrine Capital and Presidium Capital. In 2010, Mark founded Kaizen Asset Management as one of the first single-manager, multi-strategy hedge funds in South Africa. He built the firm from seed capital of US$1m to one with US$250m in assets under management. Mark then moved to Australia, to become the CIO of the ACT Capital Media Fund before joining Portal Asset Management. Mark is a CFA Charter holder with a Bachelor of Commerce (Honours) cum laude, an MBA and is an accredited Certified Financial Planner.

The Portal Digital Fund is a fund of funds. Apart from diversification, what is your approach to risk management when allocating to managers trading digital assets? The industry is relatively new and there are many parts – including regulation, taxation, infrastructure, custody, etc – that keep moving. There is also the high volatility. It isn’t the easiest risk management task one could take on, right?

Risk management and capital preservation are core to our investment strategy and fund management philosophy. The first rule of managing money is “don’t lose capital”. There is an important distinction between risk and volatility. Risk is the risk of permanent capital loss, investing in assets that lose significant value and have large liquidity discounts, whilst volatility just represents opportunity. We focus on finding the best-in-class fund managers who understand this distinction and know how to price volatility whilst avoiding real risk, particularly operational risk. Our approach to risk management is threefold: Firstly, we diversify across differentiated strategies that are not directly correlated with each other or with the market in general, and this is a combination of low, medium and high volatility funds. We have no gross exposure or gearing and manage our overall market or net exposure to maintain a Beta below 0.3, so look to mitigate the downside to 30% of macro market drawdowns. We also control for our position sizing or pin risk and don’t allow any one investment to dominate the portfolio in terms of overall size. There are a lot of moving parts as you correctly observe, and so our investment process is designed to incorporate a review of operations, research process, trade execution, portfolio construction and risk management. We address both the regulatory and operational aspects, as well as the qualitative and quantitative aspects of each fund we perform due diligence on. This ensures that we only invest in tier one funds that are operationally robust and are managed professionally by teams with deep experience and competence in both crypto assets and fund management risk frameworks. Rigorous adherence to the investment process ensures that these risks are continuously assessed and measured and to the best of our ability mitigated. This is discussed in each investment committee meeting.

What are currently the biggest risks in the digital asset space that investors need to be aware of?

The operational risks are the most prevalent, particularly the chain of custody and counterparty risk are in my opinion the biggest risk. There is also the risk that some investment managers don’t really understand volatility and don’t have adequate protection strategies in place for deep drawdowns. There is also cybersecurity and hacking risk, especially in the newer technology and bridges that we see the most defrauding on.

Tell us what sets the Portal Digital Fund apart from the other ways that investors can gain some exposure to digital assets.

We bring together an investment committee that has extensive blockchain, cryptocurrency and digital asset experience from both an enterprise and entrepreneurial perspective and we combine that with deep fund management expertise. We represent a practical, pragmatic and complete approach to all aspects of investment analysis, portfolio construction and risk management. We also focus on stewarding our investors’ funds and providing them with intergenerational wealth preservation and capital protection. There are not many teams globally that bring together a group of technology and financial professionals with more than 20 years’ experience and proven track records in their respective industries.

The fund is run on First Degree’s fund platform in Singapore. Why did you choose to work with Fish and his colleagues at First Degree?

First Degree Global Asset Management was selected after a rigorous assessment process and is an institutional-grade tier 1 investment manager. They are fully licensed by the Monetary Authority of Singapore (MAS) and have well-established relationships with the administrators, Bolder Group, bank, OCBC and auditors, Cohen and Co. They also provide excellent oversight with Stephen Fisher sitting on our investment committee to ensure compliance with our mandate and investment strategy. We essentially wanted to partner with an investment manager and service providers that would pass rigorous due diligence by any institutional investor.

Digital assets are becoming more accepted and more used by hedge funds and other professional investors. What has this institutionalisation meant for your fund and Portal as a company?

It is excellent news for Portal as an established cryptocurrency and digital asset fund manager. It opens up more investable funds and brings many new entrants to the market. It also ensures we can invest in and provide better custody solutions for our investors, as well as more assurances and access to better hedging and insurance solutions. It also removes weaker players from the market and provides more credibility for the overall industry.

The Portal Asset Management team is spread out across several time zones and jurisdictions. What are the pros and cons of not having the team in one physical location?

Getting everyone together for a meeting can be difficult given the different time zones, particularly the US/Canadian vs Australasian, but it also allows for a more balanced perspective as to what is going on the ground in different jurisdictions globally. We have investment committee members that can attend conferences in the USA and Europe, as well as team members here that have a better understanding of the developments in the Asian markets. Another advantage is that we can market the fund globally and be close to the various crypto-asset hubs such as New York City, Silicon Valley, London, Zurich and Singapore.

You have obtained both a CFA and an MBA. You have also completed the Anthony Robbins mastery program. Tell us what you think a motivational speaker such as the ebullient Anthony Robbins can teach a portfolio manager.

Psychology is everything. It is not a lack of resources that determines whether you succeed or fail, but rather a lack of resourcefulness. The teams we are competing against all have similar resources and many smart, driven members, but it is each team’s psychology that ultimately determines whether they outperform their peers. I agree with his view that it is important to have a balanced approach and combine intellectual know-how, intelligence, emotional aptitude and perseverance with hard work and persistence.

Portal has recently launched the Radiance Multi-Strategy Fund. Does Portal plan to eventually have a full offering of a wide range of digital asset funds?

Yes, Portal will have a range of investable funds that provide access across all spectrums of volatility. In line with that we currently advise on three funds:

- Low volatility: The Portal Digital Fund is a low volatility, open-ended fund that invests in hedge funds trading differentiated and liquid strategies in the crypto asset space, with a targeted return of 25%-30% p.a. net of fees*

- Medium volatility The Horizon Index Fund provides exposure to 85% of the crypto market capitalisation through an equally weighted allocation to the top 25 tokens (less stable coins). This offers investors exposure without the complexity and custody risk associated with investing directly.

- High volatility: The Radiance Global Fund is an actively managed multi-strategy fund that allocates 70% of its FUM to what we measure as best-in-class tokens and 30% to early-stage tokens and uses hedging strategies hedge to reduce and protect against market volatility.

We expect to also build out VC/PE funds and also tokenise our investment stable and provide a cryptocurrency/digital asset offering at some point.

*The Portal Digital Fund returned 83.1% in 2021 which outperformed Bitcoin at less than 1/3 of the volatility. It has been ranked #1 in the global Multi-Advisor section of the BarclayHedge Alternative Investment Rankings for 2021. BarclayHedge tracks 6,900 funds across 30 categories.