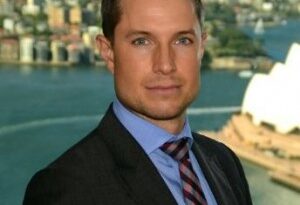

Interview: Noah’s William Ma on lessons from 2020, the outlook for 2021 and the future of HK

One of the best-known persons in Asia’s alternative investment industry, William Ma currently serves as Chief Investment Officer of both Noah Holdings and its asset management arm Gopher. Prior to joining Noah in 2015, William built a solid reputation through his roles at Penjing Asset Management, Vision Investment Management, Gottex Fund Management and HT Capital Management.

A year into the global pandemic, what has been the most important investment lesson for you in 2020?

Focus on the long-term investment objective with robust risk management and liquid portfolio profile, backed by long term investors with a similar investment philosophy. Invest in fund managers that you trust for a long time with high conviction and help them to solve any problem they might have in volatile periods. Besides diversification, investment globalisation is the second free lunch. We will continue to see its benefit in a de-globalising world.

What are your expectations for 2021?

Markets continue to be volatile but in general, we are positive on equity markets, growth assets and China. Our portfolios have been close-to fully invested in most part of 2020 and will remain so in 2021.

You are the CIO of both Noah Holdings and its asset management arm Gopher. What fund strategies are you currently seeing the most interest in and why?

Noah is one of the largest independent wealth management companies in China with USD 80 billion AUA, and according to AMAC, Gopher is the largest multi-asset, multi-strategy alternative investment management company in China with USD 25 billion AUM. We are seeing opportunities in new domestic China alternative investment strategies due to continuous opening up of the market and availability of new investment tools. For example, we are very constructive on the China multi-strategy hedge fund and see great opportunities in different sub-strategies such as Chinese Convertible Bond Arbitrage – 2019 new Chinese convertible issues are equal to the sum of 2013-2018, which is the same as the total size of 2019 China A-shares new IPOs, a very liquid market with daily turnover at peak equal to 70% of China A-shares. Managers are able to generate high Sharpe return (3x) and alpha (8%) due to the unique characteristics of the CB terms, such as downward conversion price refix. Also, Chinese Volatility Arbitrage – there is increasing popularity of structured products among retail investors. This creates an abundant supply of new investment tools such as options and derivatives for long or short volatility and volatility arbitrage strategies.

A few months ago, you joined the board of the CAIA Association and the Standards Board for Alternative Investments (SBAI) Asia Pacific Committee. How important are these organisations here in Asia as the alternative investment industry matures?

I am very excited to join the CAIA Association global board and SBAI Asia Pacific Committee, in particular at this point for the China market. The domestic China alternative investment industry AUM has recently reached a new high of US$2.5 trillion, which is close the total size of the mutual fund industry in China. This explains the importance and popularity of the alternative investment industry and products to Chinese and global investors. In this high growth area, I believe the domestic Chinese as well as Asian market participants have been actively adopting global standards. Hence, being involved in both associations allows me to facilitate the Asian alternative investment industry in further adopting global standards, as well as help global regulators and allocators to understand each individual Asian market’s practices as they could be quite different.

Professionally, you have one leg in Hong Kong and one in mainland China. What do you think is the future of Hong Kong as a financial and business hub?

I trust Hong Kong will remain a very important Asian financial hub, in particular to the China market. In 2020, the southbound flow to the Hong Kong market is US$82 billion, which is more than 2x than in 2019. Besides capital flow, there is increasing demand from domestic China asset management companies to set up offshore businesses and Hong Kong is one of their favourite locations. On the other hand, given the strong uncorrelated growth in the domestic China market and appreciating RMB, we are also seeing strong demand from global allocators to invest in the China market, both for the growth as well as the alpha opportunities in the alternative investment industry. I believe Hong Kong will play an equally important role in facilitating global investors investing in China through programs like northbound stock connect and mutual fund recognition. Hence, I am very positive about the future of Hong Kong as a financial and business hub in the region. Noah group will continue to increase the business investment in Hong Kong, expanding our team of 120 professionals in the Hong Kong office, in particular, to capture the new opportunities in the Greater Bay Area with US$1.7 trillion GDP versus Japan US$5.4 trillion, India US$2.6 trillion, Korea US$1.6 trillion and Indonesia US$1.1 trillion in the region.